Know Your Numbers, Know Thyself

We use numbers everyday whether we know it or not. There are numerous numbers directly or indirectly connected to our lives.

Numbers play an important role in our lives. Almost everything we do involves numbers and calculations. Whether or not we like it, much of our lives revolve around numbers since the day we were born.

Our society relies heavily on numbers. A world without numbers would be chaotic as we would not be able to tell time, measure things, contact people and much more. Every single day, all of us are presented forms of numbers and data to be interpreted. In many circumstances, these numbers have to be organised and read properly to make decisions pertaining to the situation.

Some examples of everyday activities that involve numbers are creating spending budgets, paying for groceries, purchasing items that are on sale. A majority of our daily activities require us to deal with numbers. One has to be able to measure out ingredients, count money, and determine limits when it comes to certain tasks like the examples above. People never realize how much numbers are around them until they take a step back and look.

We use numbers everyday whether we know it or not. There are numerous numbers directly or indirectly connected to our lives.

Health Numbers

It is important to know whether you are prone to developing major illnesses like diabetes and heart disease. In order to know this, you’ll need to be aware of the numbers that indicate the following: cholesterol, body mass index (BMI), blood sugar and blood pressure as these are all vital factors. If you are aware that the numbers are not within the healthy range, then you can take the necessary measures to try and adjust these numbers into the healthy range.

Cholesterol

High cholesterol usually does not show much outward symptoms, thus it is important to know your numbers. Your total cholesterol should be at 200 or less. Any number higher than that can put you at risk of an unexpected heart attack as high cholesterol levels means you have extra fat stored in your body. You should also know the difference between HDL cholesterol (good) and LDL cholesterol (bad) levels. Having high levels of LDL and low HDL means you are more prone to suffering a stroke or heart attack.

Blood Pressure

Blood pressure is the amount of force that it takes for your heart to pump blood through your body. High blood pressure, known as hypertension,increases your risk of heart attack, stroke and kidney disease. It can also cause damage to your brain, eyes and arteries. Blood pressure should be less than 120/80. Much like cholesterol, there are no symptoms of high blood pressure, so knowing your numbers is key to good health.

Blood Sugar

Glucose is sugar that is stored in the blood as your main source of energy. If your glucose levels are too high or too low, you can develop diabetes. Normal blood sugar level is under 100 when using the FPG test. Since diabetes can strike anyone of any age, it is essential that you know your blood sugar number. This is especially true if you experience any of the following symptoms of diabetes: frequent urination,extreme hunger, thirst, unusual weight loss, increased fatigue or blurry vision. If diabetes is left untreated, it can lead to heart disease, blindness, amputation of the arms or legs and/or kidney disease.

Body Mass Index (BMI)

BMI measures your weight in relation to your height. This measurement indicates whether

your weight falls within a normal, healthy range. Your BMI should be less than 25. A BMI over 25 indicates that you are overweight and a BMI over 30 indicates that you are obese. Carrying extra weight can lead to high cholesterol, heart disease, diabetes and other chronic conditions.

Knowing our health numbers can reduce our risk of developing some preventable conditions. By taking control of our health, we will reduce your risk of developing illnesses, and will increase our chances of living a healthier, longer life.

Financial Numbers

As a coach and consultant in the financial industry, I have met with people from all walks of life. There are those who are book smart and street smart. But no matter how well educated or independent they may be, there are times when they neglect the financial area of their lives. The details of their finances tend to get overlooked. They do not know the specifics when we get into the details of their personal financial numbers.

There are important numbers to know off the top of our head regarding our money. Remember that knowledge is power. The more we know the better position we’ll be in to make confident, educated financial decisions.

Net Worth

Your net worth is your assets (what you own) minus your liabilities (what you owe). It’s important because it gives you a baseline to start with and the ability to make tangible goals. It’s also important because it puts your finances in perspective. You could have a large house, nice car, and an impressive social life, but if your mortgage is outrageous, your car payments are unmanageable and your credit card bills are making it hard for you to save, you need to take a hard look at the numbers on both sides of your balance sheet. Net worth allows you to see progress and equity.

Cash Flow

Your cash flow is your income minus your expenses. Your cash flow is essential to help you understand your spending habits, and it allows you to anticipate how your expenses are likely to change in future and how it can impact your future financial position. Hence, it is important to review your spending habits regularly to see where you can adjust to increase your cash flow.

Financial Ratios

Financial Ratios reveals the current "state of health" of an individual or a family's portfolio. Understanding these Ratios can help you to be aware about the strengths and weaknesses of your financial status so you can make informed financial decisions.

Some of the Financial Ratios to note:

- Basic Liquidity Ratio

Basic Liquidity Ratio reflects the number of months you can sustain financially in the event that all existing sources of income are lost. It is ideal for you to have 3 to 6 months of monthly expenses as your emergency funds.

Basic Liquidity Ratio = Cash / Monthly expenses

Guideline: 3 - 6 months

- Liquid Assets To Net Worth

This Ratio represents the percentage of your net worth that is in the form of cash/near cash assets. A minimum percentage of 15% is recommended to be adequate to meet short-term liquidity needs.

Liquidity Assets to Net Worth = Cash or cash equivalent / Net Worth

Guideline: Minimum 15%

- Solvency Ratio

A person is considered to be insolvent (technically) if his total liabilities exceeds his total assets. The insolvency ratio illustrates your degree of exposure to insolvency.

Solvency Ratio = Net Worth / Total Assets

Guideline: More than 50%

- Debt To Assets Ratio

This ratio measures a person's ability to pay debts and is a broader measure of

liquidity. A ratio of not more than 50% is recommended.

Debt to Asset Ratio = Total Debts / Total Assets

Guideline: Less than 50%

- Debt Service Ratio

Debt service ratio reflects your ability to pay off debts. Knowing this ratio allows

us to understand your comfort debt level. It is recommended that you should

maintain the ratio well below 35%.

Debt Service Ratio = Total Annual Loan Repayments / Total Net Income Healthy

(Less CPF Contribution)

Guideline: Less than 35%

- Net Investment Assets To Net Worth

This ratio compares your investment assets (excluding investment in home) with

your net worth and it illustrates how well you are progressing towards your

financial goals. You should be looking at a ratio of 50% and it should be increase

as retirement approaches.

Net Investment Assets to Net Worth Ratio = Total Invested Assets / Net

Worth

Guideline: More than 50%

- Savings Ratio

Savings Ratio is the cash surplus (or deficit) from your annual income and

expenditure statement.

Savings Ratio = Savings / Gross Income

Guideline: More than 10%

Knowing our financial numbers is a game changer. It moves us from being reactive to proactive. It helps clarify our financial past, present, and future so that we can track our progress, set achievable goals, and execute on reaching them. The better our grip on these financial numbers, the better the odds that we’ll reach our goals.

For a more in-depth analysis of your financial numbers, you can request for a demo !

Personality Numbers

There are a number of personality profiling tools in the market.

Personality profiling helps you identify and explore your strengths, core personality and work preferences. These are all beneficial in helping others perceive you and the way you work. An increasing number of employers are using personality profiling to better assign roles and tasks that play to their employees’ strengths.

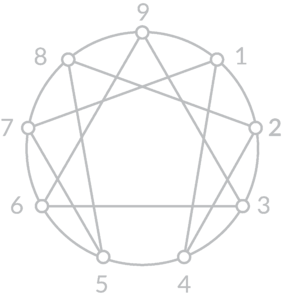

I have learnt over the years the different personality profiling systems. While many people may know about DISC or Myers-Briggs Type Indicator personality assessment, they might not be familiar with another disposition test: Enneagram.

In essence, the Enneagram enabled us to perceive and understand ourselves at more objective and deeper levels which will help us in many aspects and gain more clarity on self-knowledge.

Type 1: The Perfectionist

Ones place a lot of emphasis on following the rules and doing things correctly. Type Ones fear being imperfect and can be extremely strict with themselves and others.

Type 2: The Giver

Twos want to be liked and find ways that they can be helpful to others so that they belong. This type fears being unlovable.

Type 3: The Achiever

Threes want to be successful and admired by other people, and are very conscious of their public image. Type Threes fear failure and not being seen as valuable by other people.

Type 4: The Individualist

Fours want to be unique and to experience deep, authentic emotions. Type Fours fear they are flawed and are overly focused on how they are different from other people.

Type 5: The Investigator

Fives seek understanding and knowledge, and are more comfortable with data than other people. The biggest fear of the Type Five is being overwhelmed by their own needs or the needs of other people.

Type 6: The Skeptic

Sixes are preoccupied with security, seek safety, and like to be prepared for problems. For the Type Six, the greatest fear is being unprepared and unable to defend themselves from danger.

Type 7: The Enthusiast

Sevens want to have as much fun and adventure as possible and are easily bored. Type Sevens fear experiencing emotional pain, especially sadness, and actively seek to avoid it by staying busy.

Type 8: The Challenger

Eights see themselves as strong and powerful and seek to stand up for what they believe in. The greatest fear of the Type Eight is to be powerless, so they focus on controlling their environment.

Type 9: The Peacemaker

Nines like to go with the flow and let the people around them set the agenda. Type Nines fear pushing people away by prioritizing their own needs, and they tend to be passive.

The Enneagram sets itself apart from other personality tests by its ability to succinctly and accurately describe what motivates you and why you engage the world in your unique way of being.

Besides identifying an individual’s personality type, the Enneagram also provides insight to the person’s coping mechanisms and what mental spaces people hide in when they are stressed or traumatized and why.

The Enneagram is thus useful in helping us find out why we react to situations the way we do and be aware of how all of us react disproportionately to different emotions or dynamics and why this is so.

With that awareness, it gives us more control over our reactions to stress and other difficult circumstances. Instead of activating our fight or flight response, we can notice patterns, practice self-compassion, and make conscious choices we won’t regret.

Are you ready to find your number?

Book a consultation with us to have a more in-depth discussion.

Junwen Chen

My mission is to educate and empower people to design their lives so that they can live in abundance.

Let me partner with you, to design and nurture your dreams and ultimate life goals.

You May Also Like:

Joker. No Laughing Matter.

Happiness Is

Top 5 Risks Every Retiree Should Know

Join our mailing list to receive the latest news and exclusive insights