How To Save Tax Legally

2020 has been a roller coaster ride for most of us, with the coronavirus pandemic, lockdown, financial crisis, etc. As the year draws to an end, it also means the window for reducing your tax bill for the Year of Assessment 2021 (YA 2021) is closing.

2020 has been a roller coaster ride for most of us, with the coronavirus pandemic, lockdown, financial crisis, etc. Everything as we know it changed and we’re all still trying to figure out how to handle it or how to adapt to the ‘new normal.’

As the year draws to an end, it also means the window for reducing your tax bill for the Year of Assessment 2021 (YA 2021) is closing. This is because the size of your tax bill depends on your income, expenditure and deductions from 1 January 2020 to 31 December 2020.

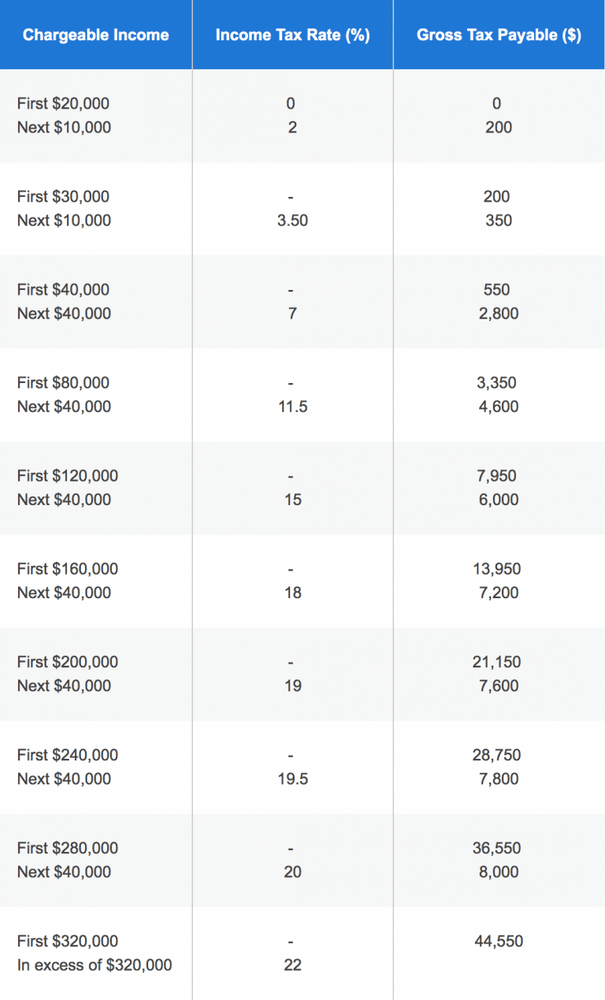

Here’s a simple illustration:

For someone earning $30k a year, they only need to pay 2% of income tax, or $200.

If you earn $3,500 a month and get a 13-month bonus, you'll be looking at an annual tax of $935. If you're luckier and get more (e.g. 3 months bonus), you can expect to pay $1,425.

But if you earn $80k annually (about $6k monthly with bonus), you'll be paying $3350.

If you earn $100k a year, you'll be paying over $5k...which could otherwise pay for a holiday to Europe!

The good thing is there are ways to reduce your tax legally.

Contents

Donate And Contribute

We make a living by what we get, but we make a life by what we give.

And the good news is when we give we can also help ourselves by reducing our tax.

Do be informed that any cash donations you make must not be in exchange for any material benefits such as gifts or brand exposure. Deductible donations are cash donations made to the Singapore Government for causes that benefit the local community or are made to an approved Institution of a Public Character (IPC).

Through this method, you can lower your chargeable income since donations made to approved institutions will allow you to claim tax relief of 250% of the amount donated. This is especially useful for those who belong in the high-income bracket.

To claim your tax relief for YA2021, make sure your donations are made before the year ends ie. donations to be made by December 2020.

Upgrade Yourself

Learn till old, live till old.

We should constantly learn and upgrade ourselves. And especially during this Covid season, we can upgrade for our skills to stay relevant to the market.

For those of you who are employed, you may claim reliefs up to $5,500 in Course Fee Relief per annum from IRAS for costs such as tuition, course or examination fees incurred through taking up a course at approved educational institutions.

We have emphasized several times in our previous articles the importance of upgrading ourselves, especially during unprecedented times like this. Now that tax reliefs are in place for attending educational courses, it should further spur you on to take them up.

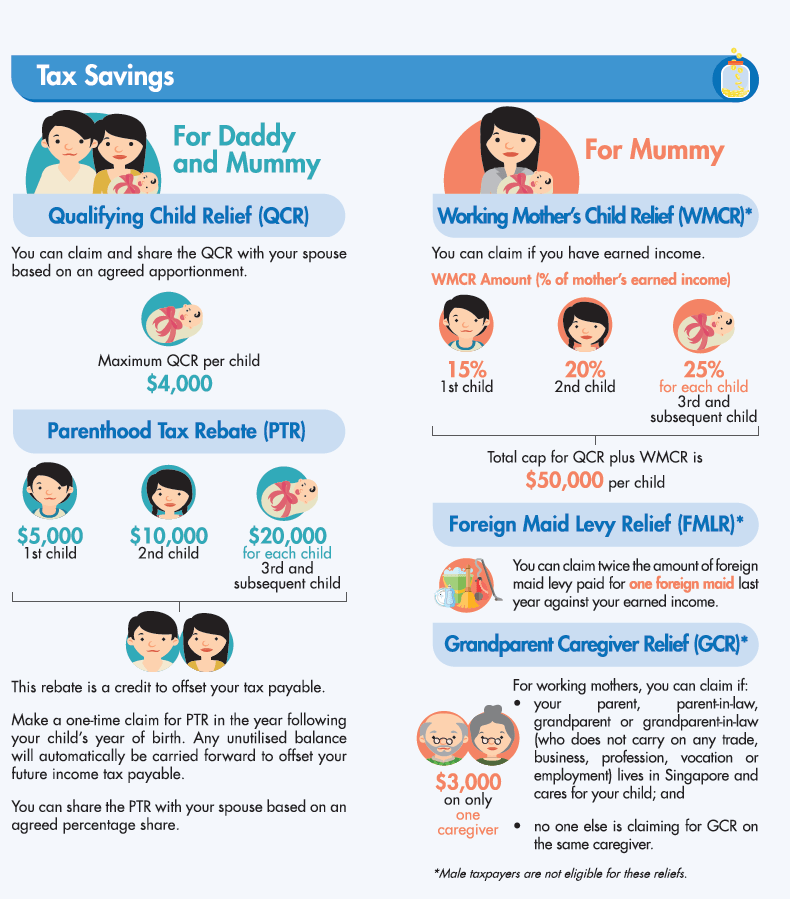

Baby Bonus

Our baby comes as a bundle of joy. With the arrival of our precious princess, we also received a substantial amount of money, tax reliefs and rebates from the government. Although these monetary benefits are nothing compared to the joy we felt from the arrival of our baby, it was still very pleasant to receive these benefits!

Then there’s the extremely generous Parenthood Tax Rebate of $5,000 for 1st child, $10,000 for 2nd, $20,000 per 3rd/subsequent child.

This isn’t a deduction from your taxable income — it’s a straight up rebate off your income tax bill!

Having a kid is tough work, and with an increasingly high cost of living here, it’s tough on the wallet as well. Luckily, parents can heave a sigh of relief with the Parenthood Tax Rebate which entitles us to a lump sum per child which you can use to offset future tax payments. Any unused amount can be carried forward to future years until it runs out.

Technically, this is akin to being “exempted” from taxes for a couple of years, because it’s highly unlikely that your 1 year’s worth of taxes will exceed the rebate amount.

There’s other tax savings for married couples and families that you can read more here.

Claiming Relevant Expenses

Did you know that the costs you incur due to employment can be deducted from your chargeable income?

Most of us would start getting excited and think that we might be able to claim expenses we made on lunches (eating outside can be expensive after all) and MRT fares… however, those are not claimable. What you might be able to subtract from your chargeable income though, are the employment expenses that you may not have been reimbursed for.

These are expenses you paid for by yourself which would usually have been covered by your employer, such as bills for dining with clients, travel for work costs and subscriptions that benefit the employer’s business.

For those who just began their own small business, you can also claim renovation costs, R&D costs or any ongoing business expenses. It is also possible to claim for depreciation of fixed assets!

For private hire drivers (like taxi, Grab or Gojek), your chargeable income is usually 60% since expenses are estimated to be 40% of your total income. However, you can claim the actual amount of your expenses if it does exceed the estimated amount.

Landlords can also claim on expenses like maintenance costs and agent fees etc. which are costs incurred in obtaining rental income. As a guideline, the tax relief for landlords is usually calculated as 15% of rental income along with the amount of interest paid on mortgage in that year.

CPF Cash Top Up

Most of us would just grow our savings by channeling money into a savings account. However, did you know that every dollar contributed through voluntary CPF top-ups makes you eligible for a dollar-for-dollar tax relief for your income tax? In other words, it is actually better to top up your own CPF Special Account and/or your loved ones’ CPF Special Account.

By doing so, you can push down your chargeable income by up to $14,000! This is because you’ll get tax reliefs of maximum $7,000 for cash top-ups to your Special Account and an additional $7,000 tax relief for cash top-ups into your family members’ Special Account. This means you might even enjoy further tax savings because you might fall into a lower tax bracket as a result.

Placing your money in the CPF Special Account also acts like an investment which gives you 4% per annum without any fees. How cool is that!

Voluntary Medisave Contribution

Aside from making voluntary contributions to your CPF Special Account, voluntary contributions to your Medisave account also allows you to claim tax reliefs if you have yet to reach your Basic Healthcare Sum. The Basic Healthcare Sum will be $63,000 for those who are turning 65 in 2021.

You’ll be killing two birds with one stone using this method as you can claim tax reliefs and at the same time set aside money for medical fees which will include paying your MediShield Life and integrated shield plan premiums. Furthermore, you can earn at least 4% interest per annum with the monies in your Medisave Account.

Supplementary Retirement Scheme (SRS)

To tackle retirement needs of Singaporeans, the government has come up with a multi-pronged strategy called the Supplementary Retirement Scheme (SRS). Unlike CPF, Contributions to SRS accounts are voluntary. The good news is that the monetary contributions you make to this scheme are eligible for a dollar-for-dollar tax relief. The annual SRS contribution cap is currently set at $15,300 for Singapore citizens and permanent residents, and $35,700 for foreigners.

Here’s an example to illustrate how the scheme works: If someone who has a taxable income of $60,000 contributes $15,300, he immediately gets to save about $1,070 in his income tax. Investing can be done using the contributions to the SRS account and whatever amount in the account can be withdrawn once you reach the statutory retirement age of 62, where withdrawal taxes are further granted a 50% concession.

And you can grow your savings even more from your SRS account with other savings and investment instruments. Learn more here.

It may not be too late to start doing things that’ll help reduce your income tax for the next year of assessment. All these means to get tax deductions in Singapore are perfectly legal, as well as meaningful and/or beneficial in some way – whether for yourself, your loved ones, or even a charity of choice that needs assistance in funding.

Get started today.

Junwen Chen

My mission is to educate and empower people to design their lives so that they can live in abundance.

Let me partner with you, to design and nurture your dreams and ultimate life goals.

You May Also Like:

The Case For PMDs

Living In The New Norm

What You Can Learn From A 2 Year Old

Join our mailing list to receive the latest news and exclusive insights